Receipt Of Donation Template

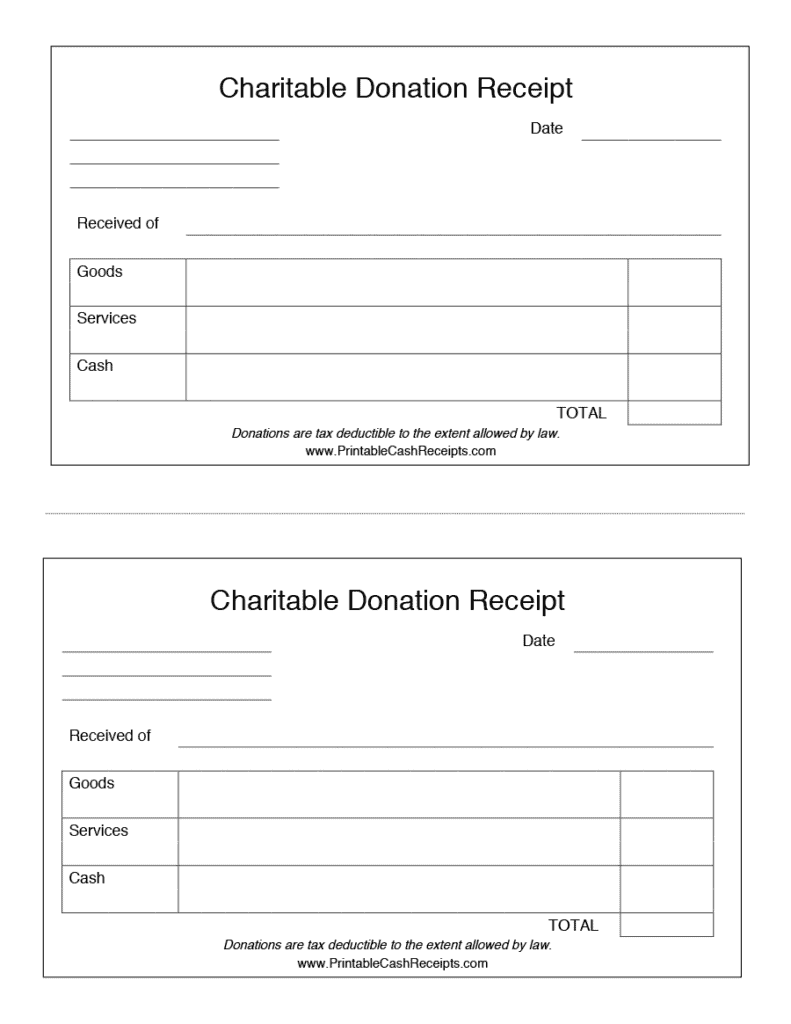

Receipt Of Donation Template - Sending back compelling and timely donation receipts increases the chances of donor retention, and using the right tech solution should minimize the efforts in the process of preparing for the tax season. Web when creating your donation receipt template, be sure to abide by irs requirements by including the following information: If a donor wishes to claim the donation on their taxes, they will need to provide a donation receipt as proof. Your donation of $250 on july 4, 2019, to our save the turtles! Web charitable donation receipt templates provide a practical and efficient way to generate accurate receipts that acknowledge and record donations. Nonprofits and charitable organizations use these to acknowledge and record contributions from donors. Web contents [ hide] 1 donation receipt templates 2 the importance of information receipts for benefactors and beneficiary 3 information which should be incorporated in a donation receipt 4 donation receipt letter 5 are all gifts or donations qualified for goodwill donation receipts? Web view & download email template for charitable donation receipt an email is a good way to provide documentation about a charitable donation and thank your donors for their help. After the receipt has been issued, the donor will be. Web donation receipt templates let’s get started! Nonprofits and charitable organizations use these to acknowledge and record contributions from donors. It is the duty of the organization receiving the donation to issue a receipt for the donor’s tax purposes. Inform the recipient about recordkeeping. Your donation of $250 on july 4, 2019, to our save the turtles! Downloadable excel invoice templates here’s our collection of donation receipt. Web updated december 18, 2023. Web donation receipt template. Email template for charitable donation receipt Your donation of $250 on july 4, 2019, to our save the turtles! It’s people like you who make what we do possible. Web a donation receipt template should comply with particular requirements when it comes to the information it contains. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. They’re important for anyone who wants to itemize their charitable giving when tax season rolls around. So, let us be the first. After the receipt has been issued, the donor will be. Nonprofits and charitable organizations use these to acknowledge and record contributions from donors. This can include cash donations, personal property, or a vehicle. Web what are donation receipt templates? Web how to give a cash donation (3 steps) accept the donation from a recipient. Web a donation receipt is a written acknowledgment that a donation was made to a nonprofit organization. Web how to give a cash donation (3 steps) accept the donation from a recipient. Deliver the written acknowledgment of the contribution. Registered nonprofit organizations can issue both “official donation tax receipts” and more informal receipts. It’s people like you who make what. Web donation receipt template 41 types of donation receipts simplify your donation receipt process and ensure transparency and gratitude towards your generous donors with our professionally designed templates. Feel free to download, modify and use any you like. Web when creating your donation receipt template, be sure to abide by irs requirements by including the following information: Web a donation. Sending back compelling and timely donation receipts increases the chances of donor retention, and using the right tech solution should minimize the efforts in the process of preparing for the tax season. Web a donation receipt is a written acknowledgment that a donation was made to a nonprofit organization. Web published july 5, 2023 • reading time: Web donation receipt. Nonprofits and charitable organizations use these to acknowledge and record contributions from donors. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. Web sample 501(c)(3) donation receipt (free template) all of these rules and regulations can be confusing. Used for recording recurring donations made on a monthly basis. You. Moreover, you can only issue a donation receipt under the name of the individual who made the donation. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. It’s people like you who make what we do possible. A donation receipt is used to claim a. Feel free to download, modify and use any you like. Deliver the written acknowledgment of the contribution. These donation receipts are written records that acknowledge a gift to an organization with a proper legal status. Nonprofit donation receipts make donors happy and are useful for your nonprofit. Web donation receipt templates let’s get started! Made to meet canada and the usa requirements. Web donation receipt template. They’re important for anyone who wants to itemize their charitable giving when tax season rolls around. You can make the email feel personal by including details about your organization and how the donation will be used. Email template for charitable donation receipt 5 minutes just as people expect a receipt when they purchase an item from a store, your supporters expect a donation receipt when they donate to your nonprofit organization. Feel free to download, modify and use any you like. Web donation receipt template 41 types of donation receipts simplify your donation receipt process and ensure transparency and gratitude towards your generous donors with our professionally designed templates. Used for recording recurring donations made on a monthly basis. Web in the us, it is required that an organization gives a donation receipt for any contribution that is $250 or more. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. These donation receipts are written records that acknowledge a gift to an organization with a proper legal status. Donors use them as a confirmation that their gift was received; It is the duty of the organization receiving the donation to issue a receipt for the donor’s tax purposes. Web a donation receipt template should comply with particular requirements when it comes to the information it contains. Web contents [ hide] 1 donation receipt templates 2 the importance of information receipts for benefactors and beneficiary 3 information which should be incorporated in a donation receipt 4 donation receipt letter 5 are all gifts or donations qualified for goodwill donation receipts?

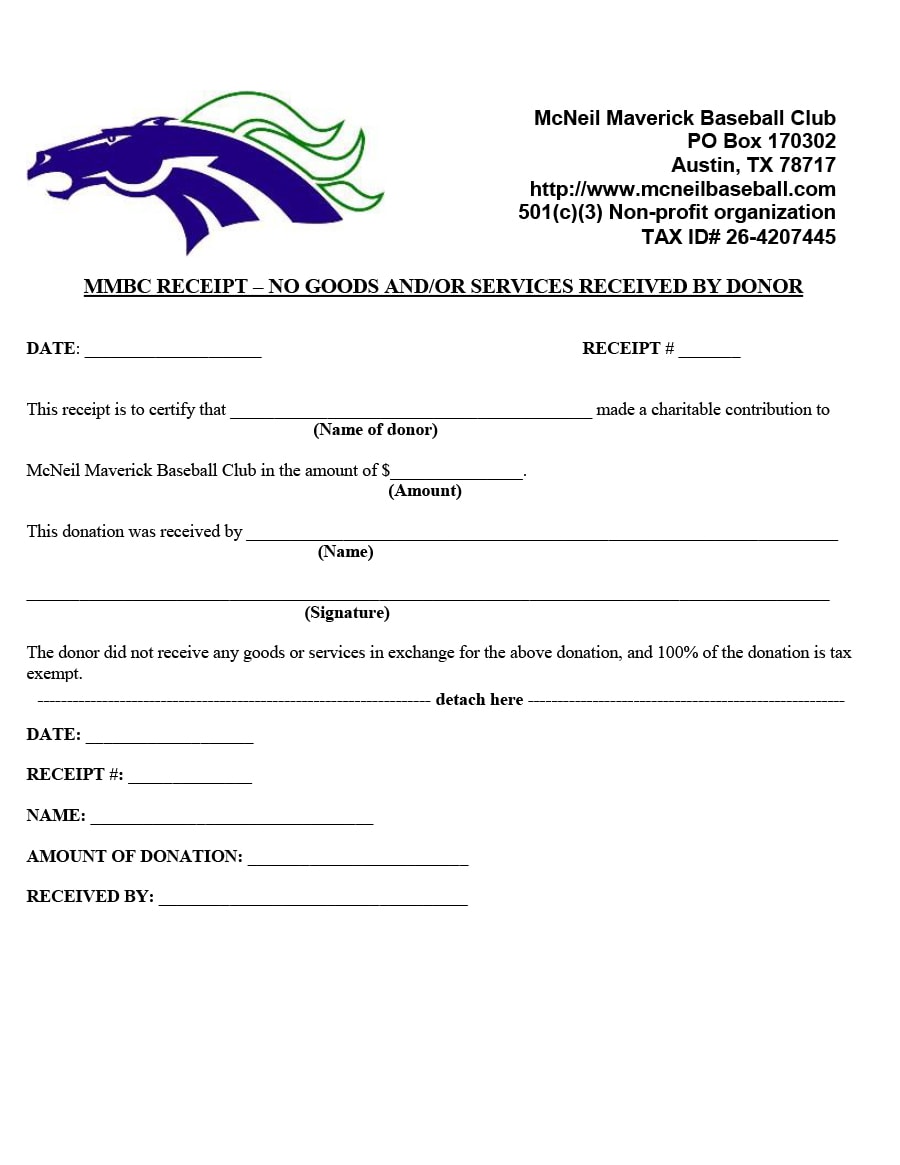

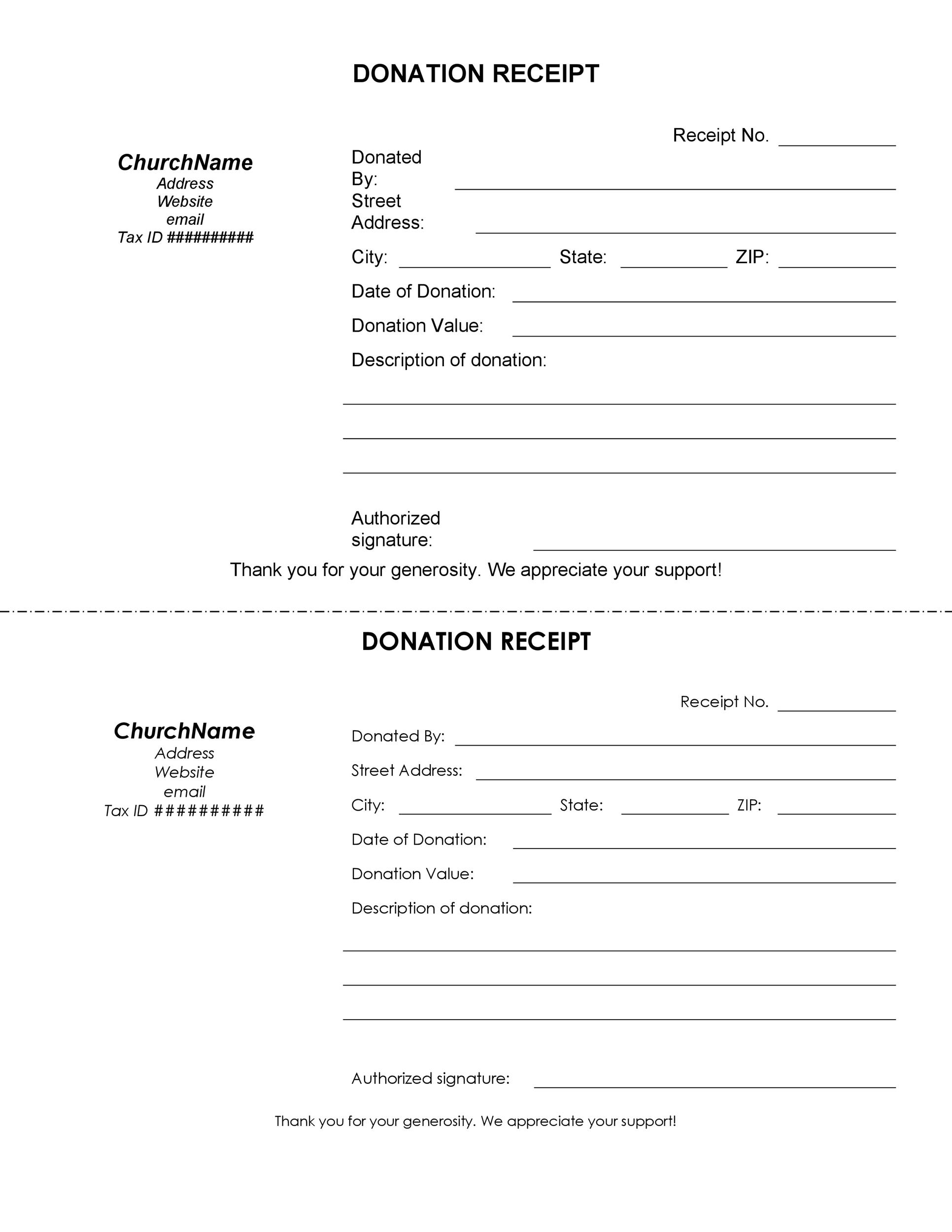

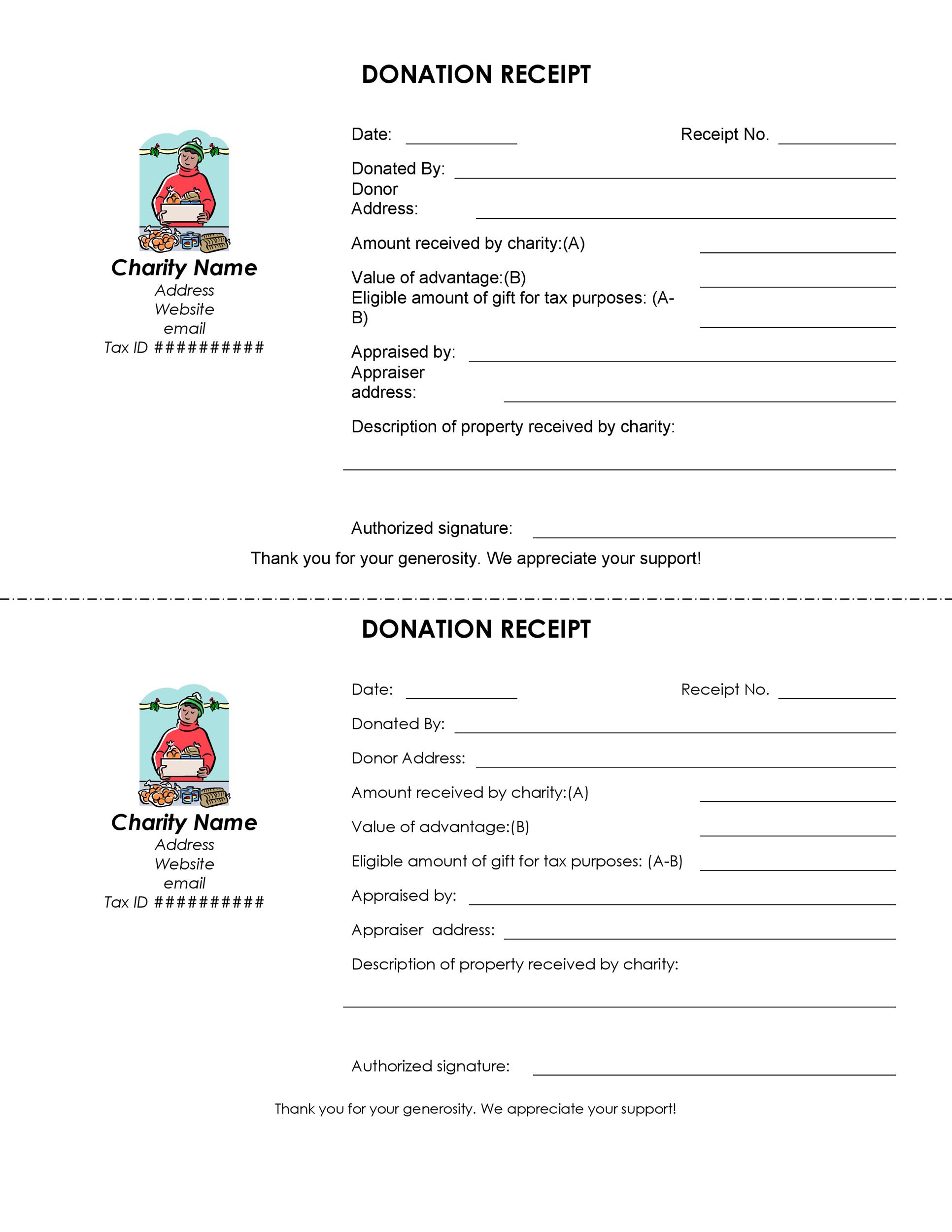

Printable Donation Receipt Letter Template Printable Templates

FREE 7+ Sample Donation Receipt Letter Templates in PDF MS Word

50+ Free Receipt Templates (Cash, Sales, Donation, Taxi...)

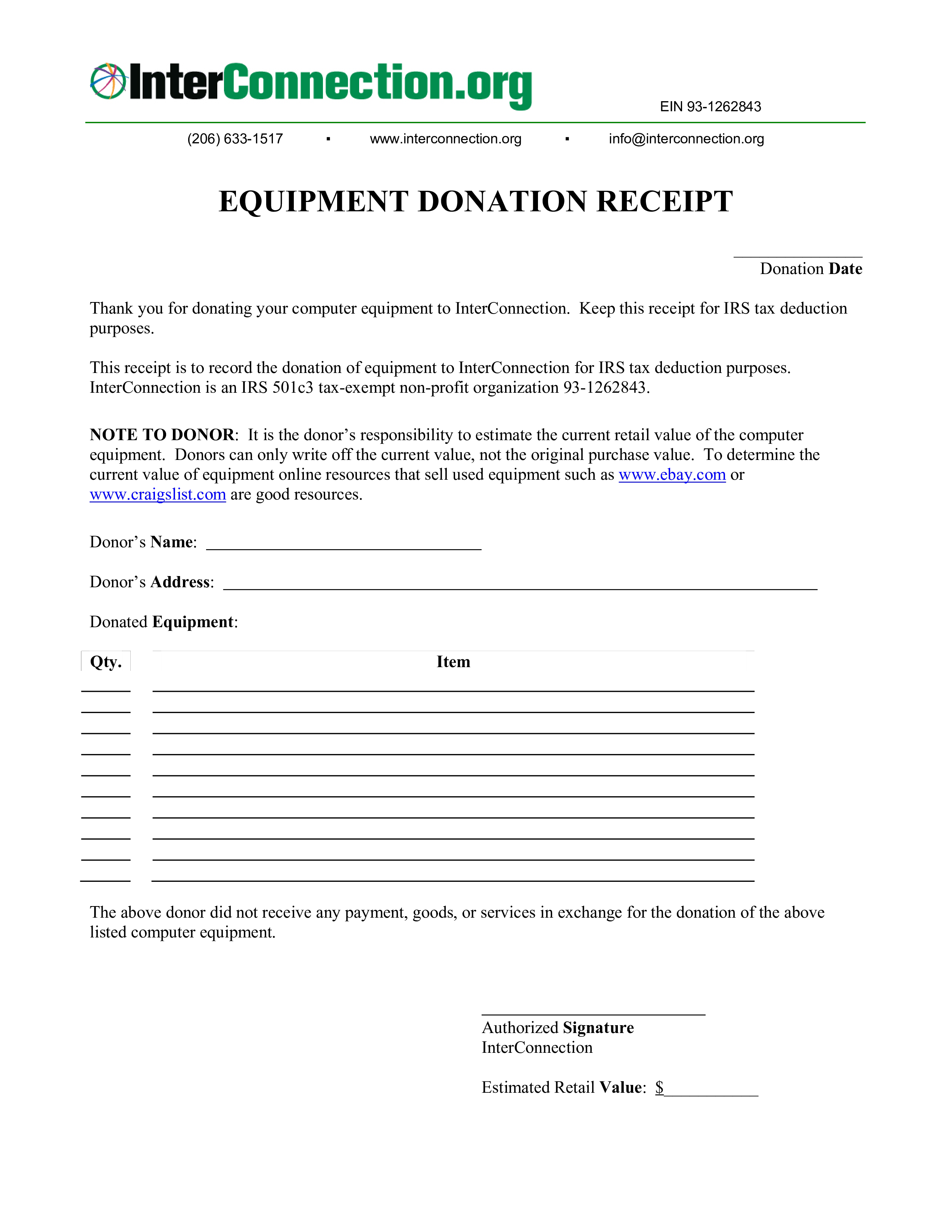

Equipment Donation Receipt Templates at

50+ Free Receipt Templates (Cash, Sales, Donation, Taxi...)

Donation Receipt Template in Microsoft Word

![501c3 Donation Receipt Template Printable [Pdf & Word]](https://templatediy.com/wp-content/uploads/2022/03/501c3-Donation-Receipt-Template.jpg)

501c3 Donation Receipt Template Printable [Pdf & Word]

Ultimate Guide to the Donation Receipt 7 MustHaves & 6 Templates

6+ Free Donation Receipt Templates Word Excel Formats

FREE 12+ Donation Receipt Forms in PDF MS Word Excel

If A Donor Wishes To Claim The Donation On Their Taxes, They Will Need To Provide A Donation Receipt As Proof.

Moreover, You Can Only Issue A Donation Receipt Under The Name Of The Individual Who Made The Donation.

Primarily, The Receipt Is Used By Organizations For Filing Purposes And Individual Taxpayers To Provide A Deduction On Their State And Federal (Irs) Income Tax.

This Donations Receipt Template Provides Official Documentation And Information Regarding The Gift Or Money Made By A Donor.

Related Post: