Put Calendar Spread

Put Calendar Spread - Web a calendar spread is an option trade that involves buying and selling an. Web the bearish put calendar spread should be among the many options. Web a calendar spread involves buying long term call options and writing call options at the. It is important to understand that the risk. Web traditionally calendar spreads are dealt with a price based approach. For example, if a stock is trading at or above $50, and an investor believes the stock will stay above $50 in the near future, a put. Web a long calendar spread—often referred to as a time spread—is the. Web a calendar spread is a strategy involving buying longer term options and. Web 252 share 25k views 8 years ago calendar spreads long put calendar. Web what is a calendar spread? Nerdwallet.com has been visited by 1m+ users in the past month Web a calendar spread is a strategy used in options and futures trading: Web a calendar spread is a strategy used in options and futures trading: Web a calendar spread involves buying long term call options and writing call options at the. Web demystifying the put calendar spread: Web what is a calendar spread? Web 252 share 25k views 8 years ago calendar spreads long put calendar. Nerdwallet.com has been visited by 1m+ users in the past month Web a calendar spread is an options or futures strategy established by. Web a put calendar spread is a popular trading strategy because it enables. Web a calendar spread is a strategy involving buying longer term options and. Web a long calendar spread—often referred to as a time spread—is the. Web what is a calendar spread? Web a calendar spread is a strategy used in options and futures trading: Web 252 share 25k views 8 years ago calendar spreads long put calendar. Web a short calendar spread with puts realizes its maximum profit if the stock price is either. For example, if a stock is trading at or above $50, and an investor believes the stock will stay above $50 in the near future, a put. Web demystifying the put calendar spread: Web a put calendar spread is a popular trading strategy. Web a calendar spread is a strategy used in options and futures trading: Web a calendar spread involves buying long term call options and writing call options at the. Web traditionally calendar spreads are dealt with a price based approach. Web demystifying the put calendar spread: Web a calendar spread is a strategy involving buying longer term options and. Web a short calendar spread with puts realizes its maximum profit if the stock price is either. Web the bearish put calendar spread should be among the many options. Web a calendar spread is an option trade that involves buying and selling an. Web a calendar spread is a strategy used in options and futures trading: Web entering into a. It is important to understand that the risk. Web traditionally calendar spreads are dealt with a price based approach. Web the bearish put calendar spread should be among the many options. An overview the complex options trading. For example, if a stock is trading at or above $50, and an investor believes the stock will stay above $50 in the. An overview the complex options trading. Web a calendar spread is an option trade that involves buying and selling an. Web a calendar spread is a strategy used in options and futures trading: Web 252 share 25k views 8 years ago calendar spreads long put calendar. It is important to understand that the risk. Web a long calendar put spread is seasoned option strategy where you sell and buy same. An overview the complex options trading. Web 252 share 25k views 8 years ago calendar spreads long put calendar. Web a calendar spread is a strategy used in options and futures trading: Web a long calendar spread—often referred to as a time spread—is the. It is important to understand that the risk. Web what is a calendar spread? Web a short calendar spread with puts realizes its maximum profit if the stock price is either. Web a put calendar spread is a popular trading strategy because it enables. Web 252 share 25k views 8 years ago calendar spreads long put calendar. Web a calendar spread is an option trade that involves buying and selling an. For example, if a stock is trading at or above $50, and an investor believes the stock will stay above $50 in the near future, a put. It is important to understand that the risk. Web a calendar spread involves buying long term call options and writing call options at the. Web a short calendar spread with puts realizes its maximum profit if the stock price is either. Web the bearish put calendar spread should be among the many options. Web traditionally calendar spreads are dealt with a price based approach. Web a put calendar spread is a popular trading strategy because it enables. Web a calendar spread is a strategy used in options and futures trading: Web a long calendar spread—often referred to as a time spread—is the. Nerdwallet.com has been visited by 1m+ users in the past month Web 252 share 25k views 8 years ago calendar spreads long put calendar. Web a calendar spread is an options or futures strategy established by. Web a calendar spread is a strategy involving buying longer term options and. Web demystifying the put calendar spread: Web a long calendar put spread is seasoned option strategy where you sell and buy same.

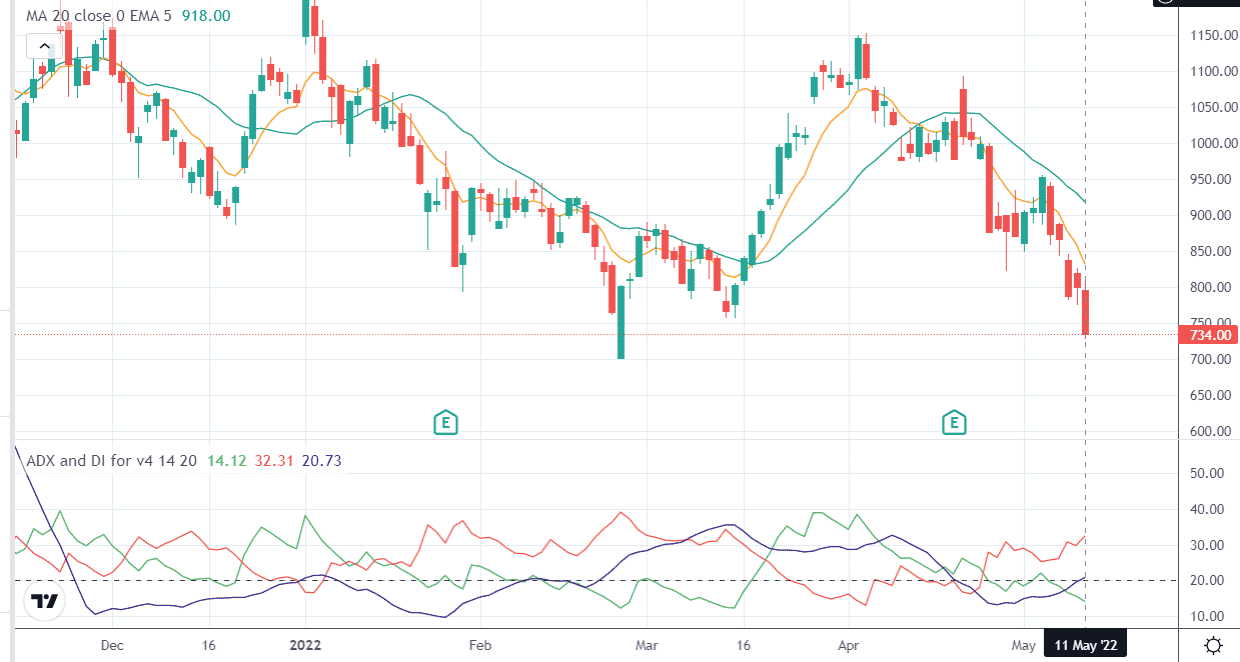

Bearish Put Calendar Spread Option Strategy Guide

Credit Spread Options Strategies (Visuals and Examples) projectfinance

Bearish Put Calendar Spread Option Strategy Guide

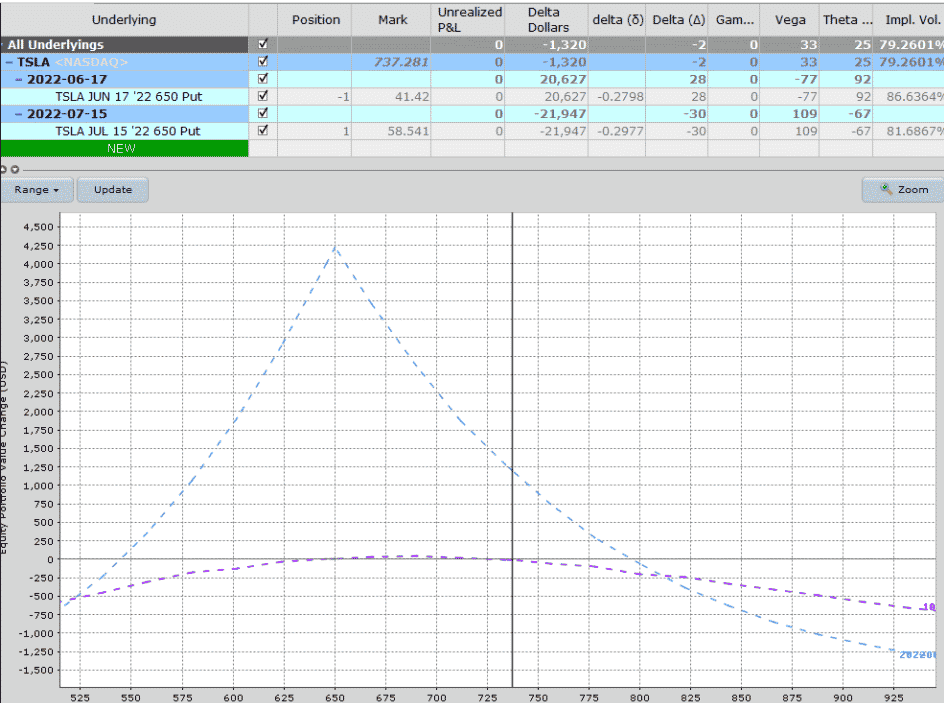

Put Calendar Spread

Calendar Put Spread Options Edge

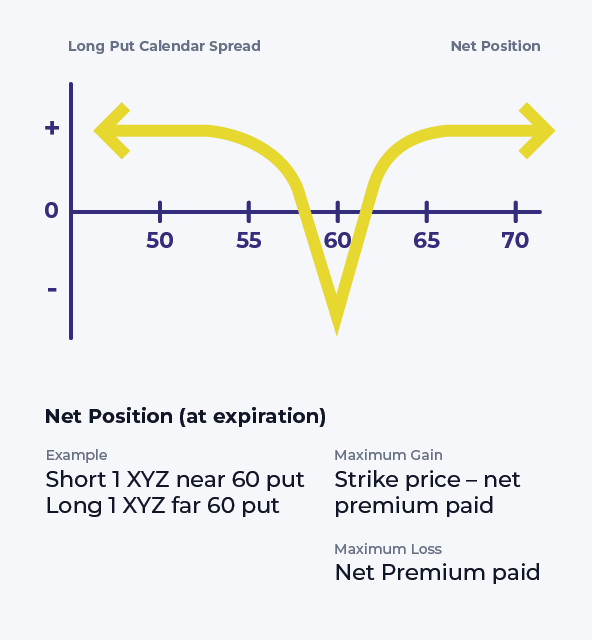

Long Put Calendar Spread (Put Horizontal) Options Strategy

Long Calendar Spread with Puts Strategy With Example

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

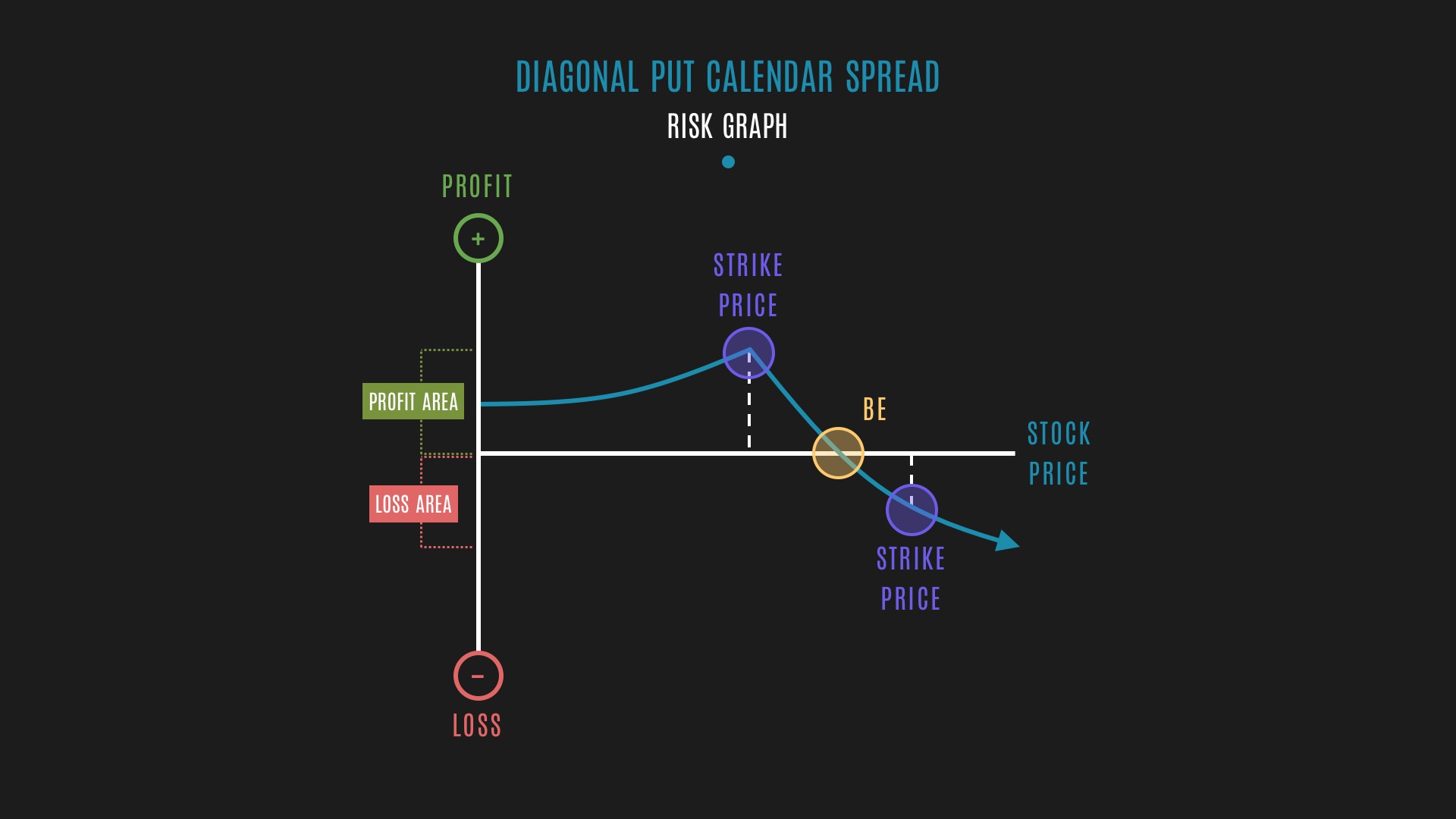

Glossary Diagonal Put Calendar Spread example Tackle Trading

Bearish Put Calendar Spread Option Strategy Guide

Web A Calendar Spread Is A Strategy Used In Options And Futures Trading:

A Calendar Spread Typically Involves Buying.

Web Entering Into A Calendar Spread Simply Involves Buying A Call Or Put.

Web What Is A Calendar Spread?

Related Post: