Can A 1099 Employee Draw Unemployment

Can A 1099 Employee Draw Unemployment - Web in short, 1099 independent contractors cannot collect unemployment. Web though many companies use the term 1099 employee, it isn’t really accurate because the irs classifies workers who receive 1099s as nonemployees. However, the federal government created new provisions that allow 1099 earners to tap into unemployment benefitsduring the ongoing. The factors below are used. Appreciation week · event calendar · webinars In most states, companies pay a tax to cover. The federal agency you worked for. Web on top of the ppp program and tax changes, the cares act also opens the door for some 1099 earners to receive unemployment benefits from the pandemic. There are a number of different benefits you can offer your 1099 workers. Web unemployment insurance benefits are subject to state and federal income taxes. Assistance is available for periods of unemployment between. In most states, companies pay a tax to cover. Web in short, 1099 independent contractors cannot collect unemployment. Web what benefits can you offer 1099 workers? Web though many companies use the term 1099 employee, it isn’t really accurate because the irs classifies workers who receive 1099s as nonemployees. These benefits are available to employees because their employers pay state. Historically, 1099 employees could not collect unemployment; In most states, companies pay a tax to cover. Web though many companies use the term 1099 employee, it isn’t really accurate because the irs classifies workers who receive 1099s as nonemployees. Web in short, 1099 independent contractors cannot collect unemployment. A 1099 employee is one that doesn't fall under. Web am i eligible for unemployment benefits? The factors below are used. Everything you need to know. You may be an employee under the law, even if: Web what benefits can you offer 1099 workers? Web workers receiving a form 1099 typically don’t qualify for unemployment benefits. You can elect to have deductions taken out at the time you file your claim or after. Web in short, 1099 independent contractors cannot collect unemployment. Web on top of the ppp program and tax changes, the cares act also. You do, however, have the. Health insurance, dental and vision. These benefits are available to employees because their employers pay state. Web though many companies use the term 1099 employee, it isn’t really accurate because the irs classifies workers who receive 1099s as nonemployees. Historically, 1099 employees could not collect unemployment; Web in short, 1099 independent contractors cannot collect unemployment. Web though many companies use the term 1099 employee, it isn’t really accurate because the irs classifies workers who receive 1099s as nonemployees. A 1099 employee is one that doesn't fall under. Everything you need to know. The factors below are used. Startup law resources employment law, human resources. You may be eligible if you are partially (working less hours) or totally unemployed due to no fault of your own. In most states, companies pay a tax to cover. Neither independent contractors, nor their. You may be an employee under the law, even if: Web in short, 1099 independent contractors cannot collect unemployment. Appreciation week · event calendar · webinars In most states, companies pay a tax to cover. Web ordinarily, when you're an independent contractor (also called a 1099 employee), you can't collect unemployment if you're out of work. Web on top of the ppp program and tax changes, the cares act also. Health insurance, dental and vision. Appreciation week · event calendar · webinars Web workers receiving a form 1099 typically don’t qualify for unemployment benefits. You may be eligible if you are partially (working less hours) or totally unemployed due to no fault of your own. Assistance is available for periods of unemployment between. Web though many companies use the term 1099 employee, it isn’t really accurate because the irs classifies workers who receive 1099s as nonemployees. Web these benefits were recently updated and extended when the continued assistance for unemployed workers act of 2020 (continued assistance act) was signed. Startup law resources employment law, human resources. Health insurance, dental and vision. You may. Web am i eligible for unemployment benefits? Assistance is available for periods of unemployment between. A 1099 employee is one that doesn't fall under. Web ordinarily, when you're an independent contractor (also called a 1099 employee), you can't collect unemployment if you're out of work. You can elect to have deductions taken out at the time you file your claim or after. You do, however, have the. Neither independent contractors, nor their. Appreciation week · event calendar · webinars These benefits are available to employees because their employers pay state. Web in short, 1099 independent contractors cannot collect unemployment. Existing claimants who have maxed out their unemployment benefits. There are a number of different benefits you can offer your 1099 workers. Web what benefits can you offer 1099 workers? You may be an employee under the law, even if: Web on top of the ppp program and tax changes, the cares act also opens the door for some 1099 earners to receive unemployment benefits from the pandemic. You may be eligible if you are partially (working less hours) or totally unemployed due to no fault of your own.

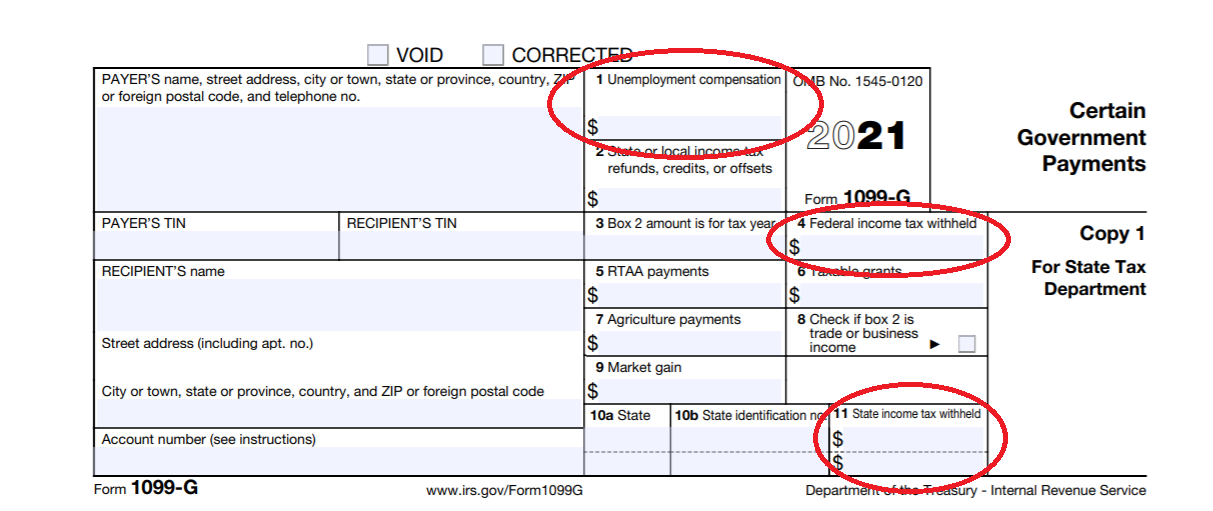

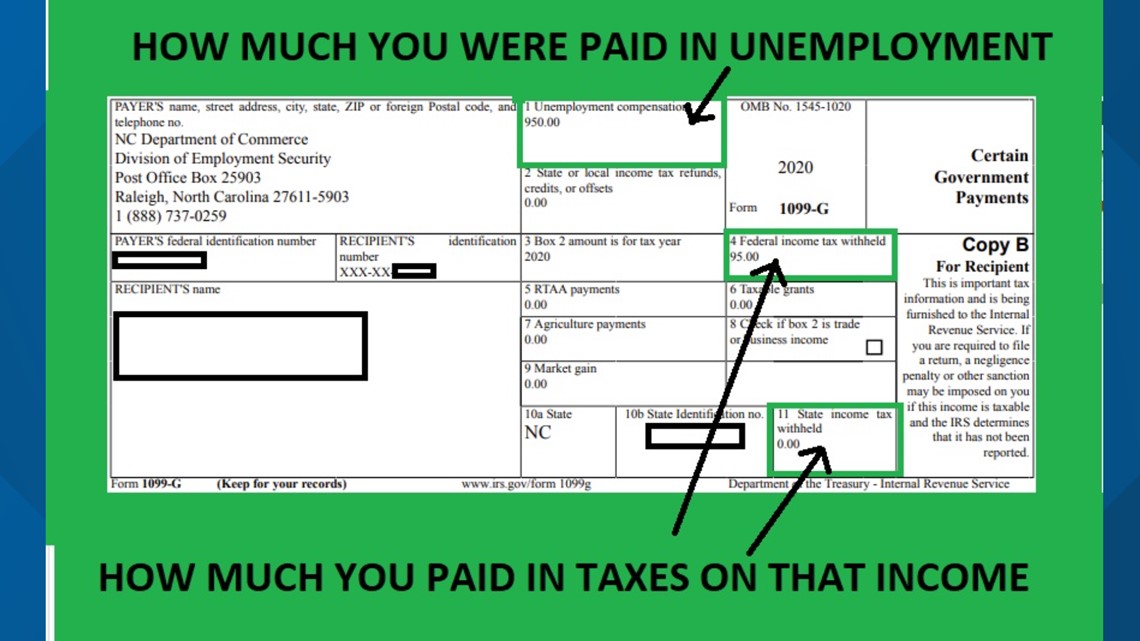

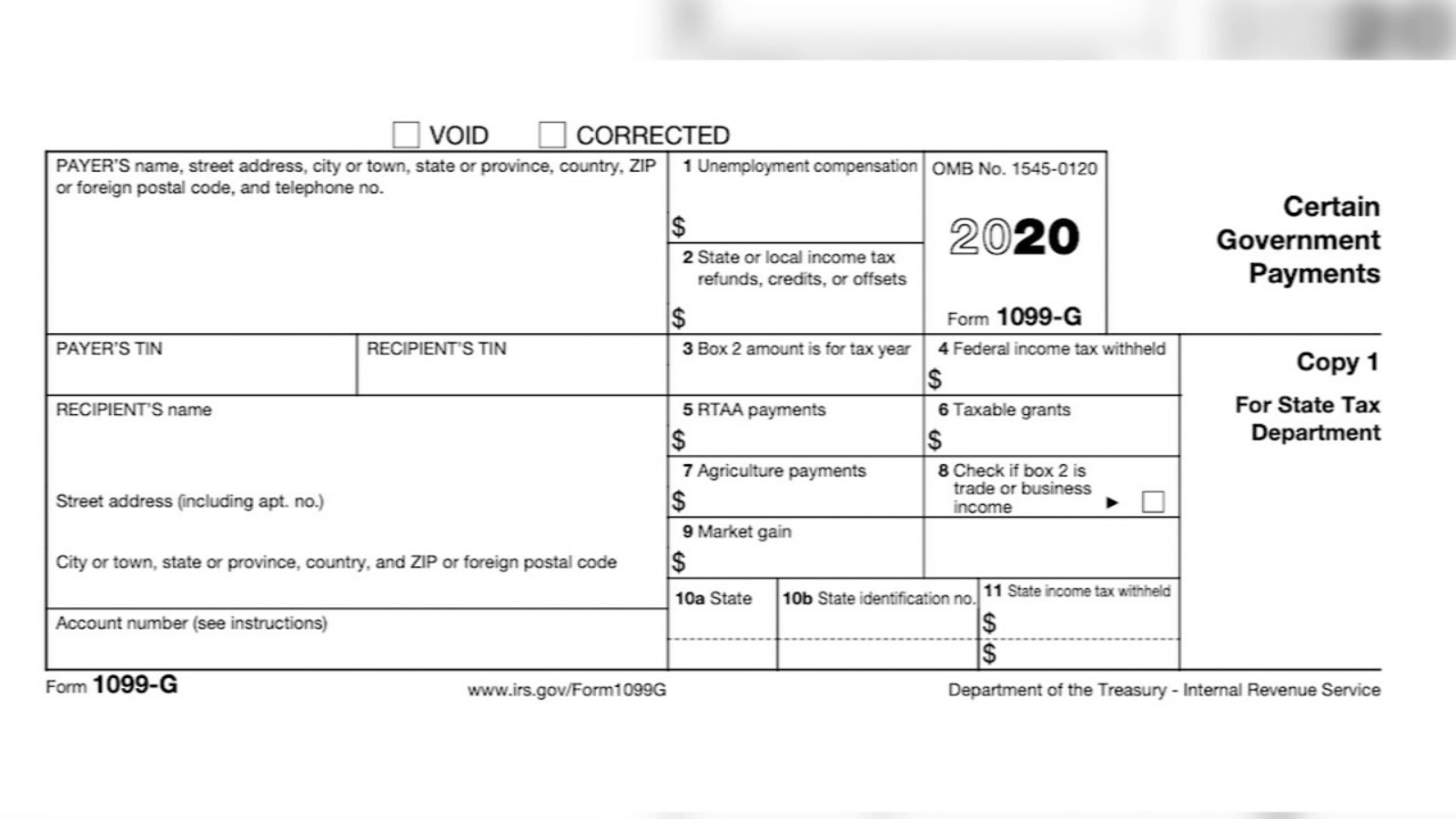

How to Report your Unemployment Benefits on your Federal Tax Return

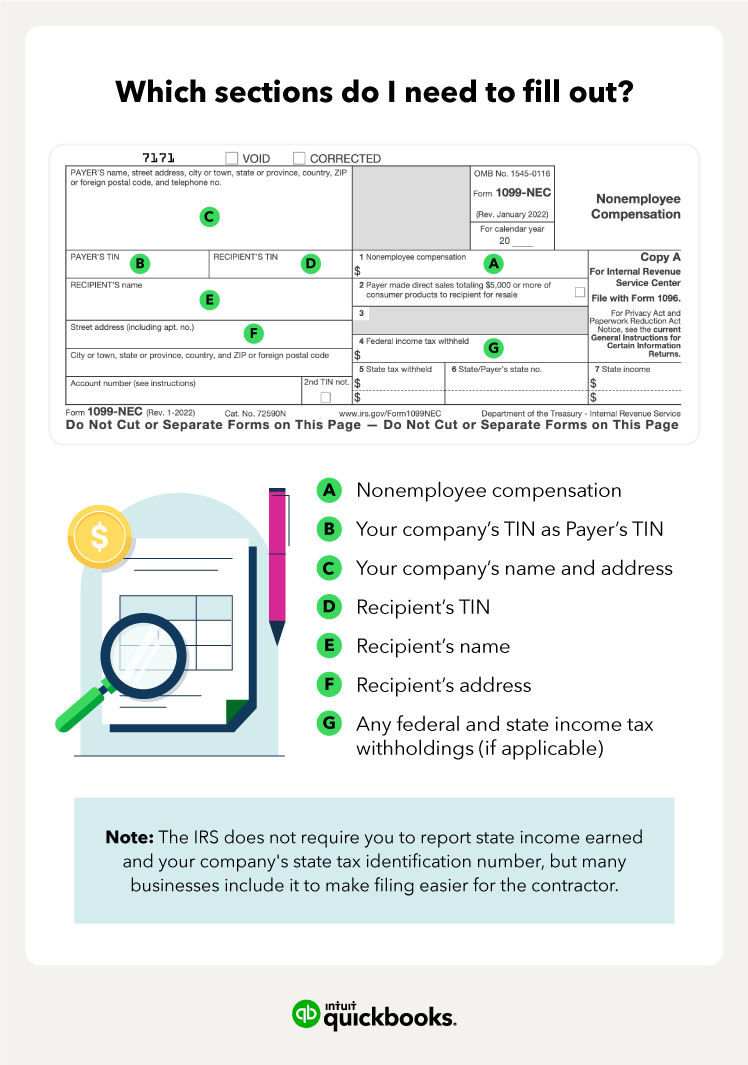

How to fill out a 1099 form QuickBooks

Can a 1099 Collect Unemployment? got1099

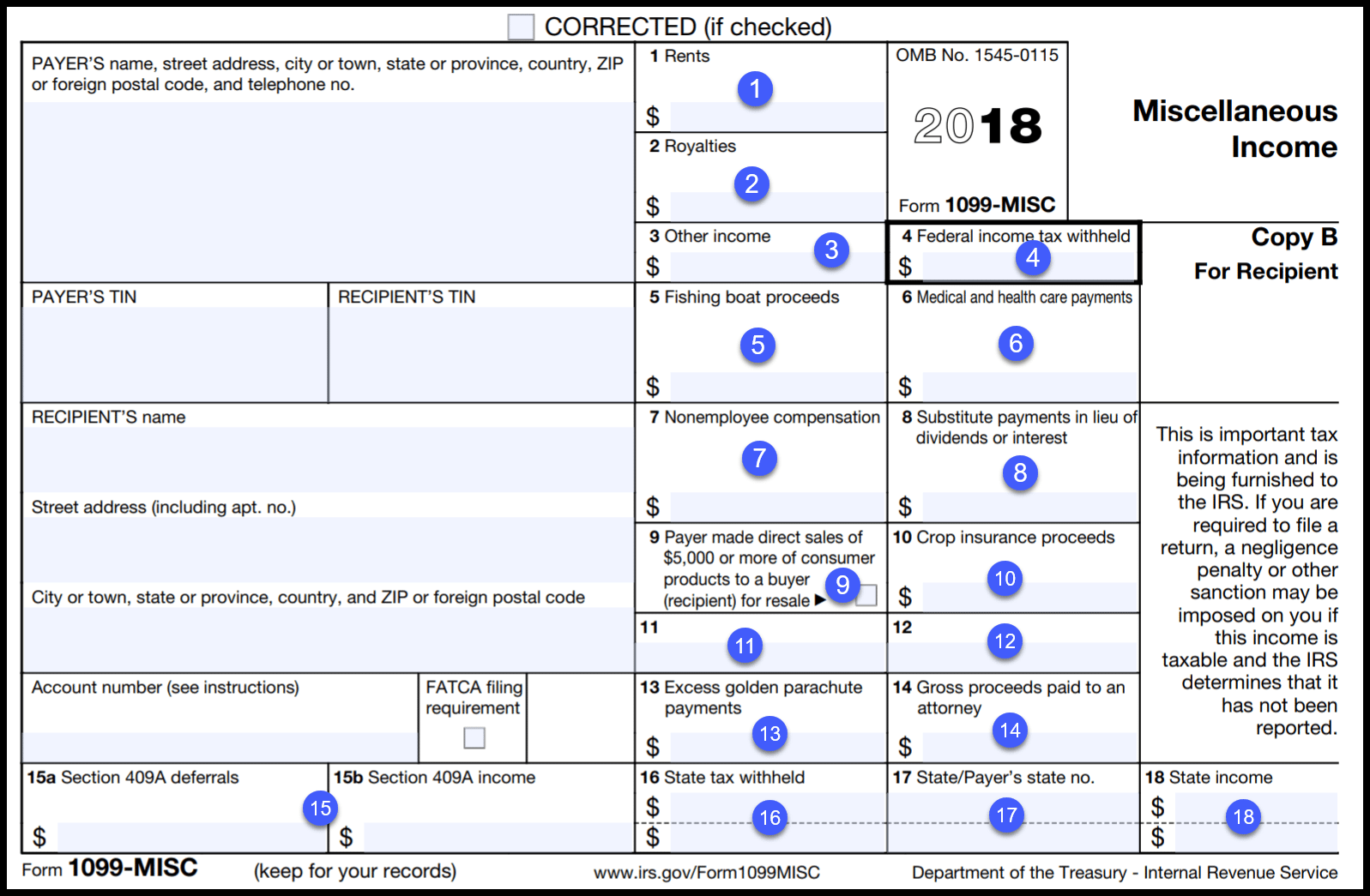

1099 Form

What Is A 1099 Form A Simple Breakdown Of The IRS Tax Form

What Is a 1099 Form, and How Do I Fill It Out? Bench Accounting

IRS Form 1099 Reporting for Small Business Owners

Unemployment benefits are taxable, look for a 1099G form

1099G Unemployment Forms Necessary to File Taxes Are Now Available at

1099 Basics & FAQs ASAP Help Center

Web Though Many Companies Use The Term 1099 Employee, It Isn’t Really Accurate Because The Irs Classifies Workers Who Receive 1099S As Nonemployees.

In Most States, Companies Pay A Tax To Cover.

Web Unemployment Insurance Benefits Are Subject To State And Federal Income Taxes.

Startup Law Resources Employment Law, Human Resources.

Related Post: